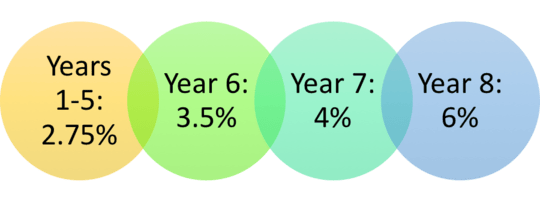

38+ conventional adjustable rate mortgage

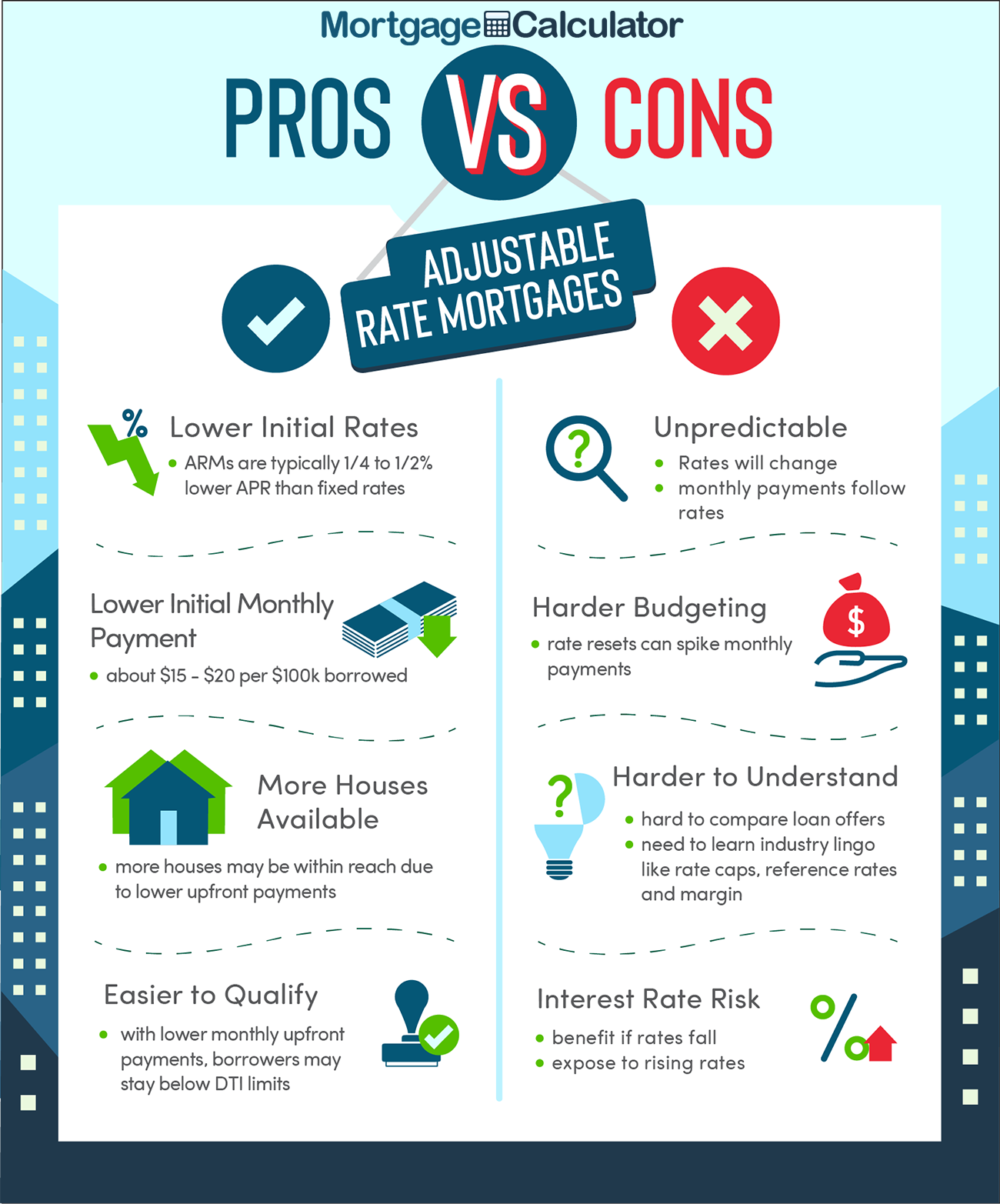

Web When asked why someone might hesitate to get an ARM 38 of people listed the potential for higher monthly interest rates and 335 listed the potential to pay more over the lifetime of the loan. The ARM loan may include an.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

71 adjustable rate of 4875 2.

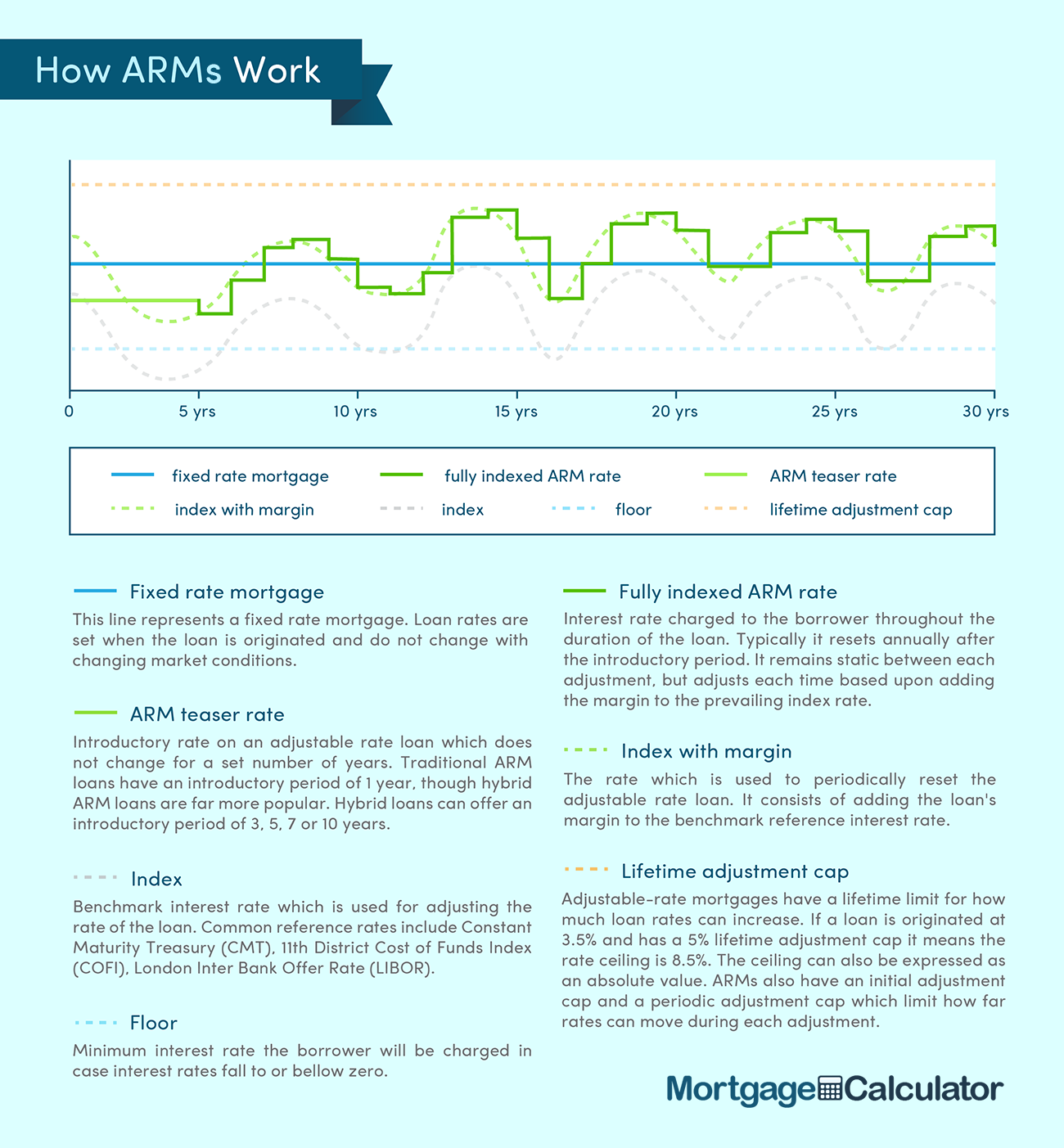

. Web Adjustable-rate mortgages or ARMs have an initial fixed-rate period during which the interest rate doesnt change followed by a longer period during which the rate may change at preset intervals. Web An adjustable-rate mortgage ARM is a loan in which the interest rate may change periodically usually based upon a pre-determined index. Web In our hypothetical example lets say you can get a 30-year fixed-rate mortgage at 4.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Most adjustable-rate mortgages have an introductory period where the rate of interest and monthly payments are fixed.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web The average mortgage rate in Arizona is currently 738 for the 30-year fixed loan term. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

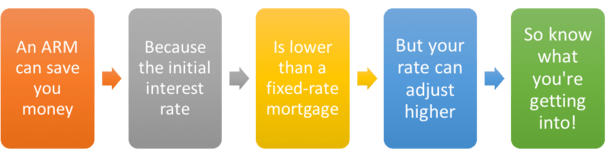

After the initial introductory period the loan shifts from acting. Web An adjustable rate mortgage ARM from CrossCountry Mortgage may help you save money on your loan especially if youll be living in the home for only a few years. Estimate Your Monthly Payment Today.

Web Adjustable-Rate Mortgage Calculator Calculate your adjustable mortgage payment Adjustable-rate mortgages can provide attractive interest rates but your payment is not. Compare More Than Just Rates. Ad More Veterans Than Ever are Buying with 0 Down.

101 adjustable rate of 500 2. Financing homeownership with a sequence of conventional fixed-rate mortgage products implies additional indirect costs. Ad Be Confident Youre Getting the Right Mortgage.

Web How Does an Adjustable-rate Mortgage Work. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. They are also called variable-rate.

Web A 51 adjustable-rate mortgage has an average rate of 563 a rise of 11 basis points from the same time last week. Ad Be Confident Youre Getting the Right Mortgage. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web How are conventional mortgage rates determined. Well compare that against a 51 ARM with 225 caps and an initial. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

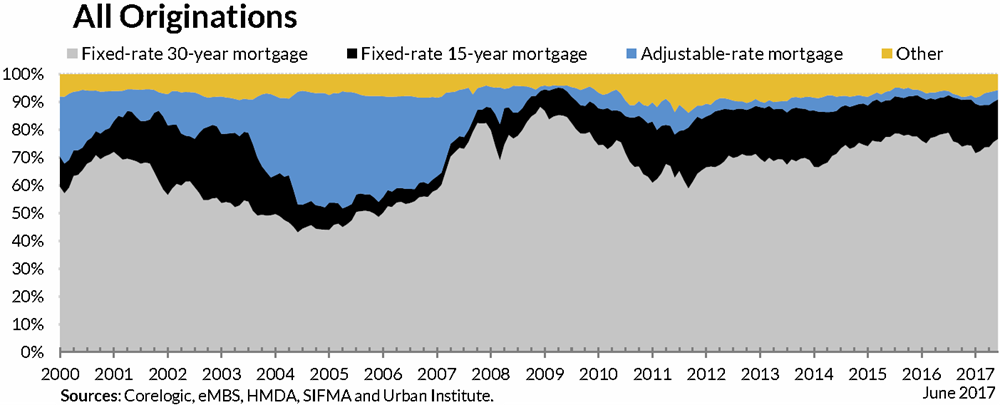

Web Using data from the latest refinance wave this Economic Brief estimates the mortgage refinance transaction costs paid by the borrowers in 2020 at 445 billion. For the first five years youll usually get a. Save Real Money Today.

Web An Adjustable-rate mortgage calculator is a type wherein the user can calculate the periodical installment amount wherein interest rate changes after fixed intervals throughout the borrowing period. Compare Mortgage Options Calculate Payments Get Quotes. Apply Now With Quicken Loans.

Adjustable Rate Mortgage Calculator P x R x 1RN 1RN-1 Wherein P is the loan amount R is the rate of interest per annum. Web Typically a down payment between three and 20 percent is required for a conventional loan and a monthly mortgage insurance payment called PMI is required of buyers who. Web Adjustable-rate mortgages have interest rates that are variable meaning they fluctuate.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. 51 adjustable rate of 475 2. Both of these are accurate assessments because with an adjustable-rate mortgage interest rates will increase or decrease with market shifts.

Compare Mortgage Options Calculate Payments Get Quotes. Here are the interest rates offered to Arizona residents looking to buy or refinance a home as of 02072023. Apply Now With Quicken Loans.

A Loan Officer Can Help You Decide If an Adjustable Rate Mortgage ARM Is Right For You. Of course the inverse is. Save Time Money.

Web An adjustable-rate mortgage ARM is a home loan that starts out with a fixed interest rate but after a period of time that rate becomes variable. With a fixed-rate loan youll pay one set amount every month for the duration of your loan term like 15 20 or 30. Ad We Offer Competitive ARM Rates Fees.

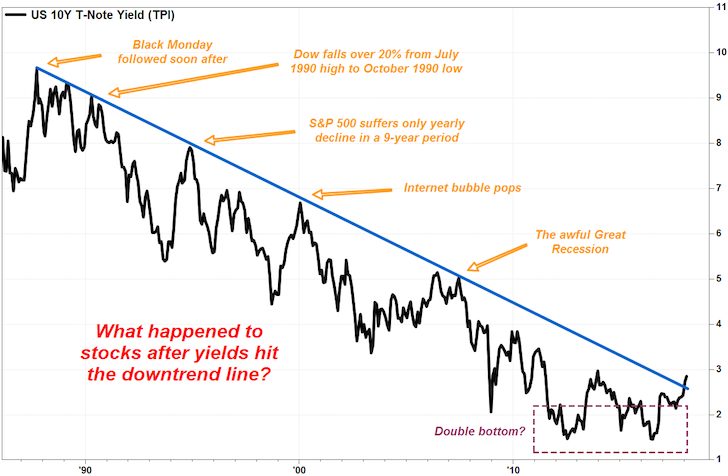

Lenders typically base fixed-interest mortgage rates on two factors 10-year Treasury rates and demand by investors in. Find A Lender That Offers Great Service. Web 1 For a 300000 mortgage loan for a term of.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. A simple redesign of the adjustable-rate mortgage contract. Based on 80 loan to value and 1.

Youll usually have your initial interest rate for a few years typically three. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Depending on market conditions an adjustable-rate mortgage could provide you with an improvement on existing rates that could yield real savings.

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Adjustable Rate Mortgages Guide For First Time Buyers

Adjustable Rate Mortgage Loans Arms Navy Federal Credit Union

Adjustable Rate Mortgages Are Back But Are They Worth The Risk

:max_bytes(150000):strip_icc()/what-is-an-adjustable-rate-mortgage-3305811_V2-d24ce035796b4b3ebb7cee3f65049a24.png)

Adjustable Rate Mortgage Definition Types Pros Cons

Conventional Adjustable Rate Mortgage Arm Mortgage Solutions Of St Louis

Adjustable Rate Mortgages And The Buydown Option

3 1 Arm Calculator 3 Year Hybrid Adjustable Rate Mortgage Calculator

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Adjustable Rate Mortgage Loans Arms Navy Federal Credit Union

Adjustable Rate Mortgage Loans Arms Navy Federal Credit Union

Conventional Adjustable Rate Mortgage Arm Mortgage Solutions Of St Louis

Adjustable Rate Mortgage 101 How They Work And Why They Can Be A Cheaper Option

Scientific Bulletin

Adjustable Rate Mortgage 101 How They Work And Why They Can Be A Cheaper Option

Adjustable Rate Mortgage Arm 2022 Rates Quicken Loans

Pros And Cons Of Adjustable Rate Mortgages Arm Loan First Time Home Buyer Youtube